Chennai office market is resilient

The resilience of Chennai’s office market.

In India, Chennai has carved an identity as a stable office market, unlike its southern counterparts like Bengaluru or Hyderabad. Its manufacturing hub status and talent pool have always attracted occupiers across segments. There were no major upheavals until the floods of 2015, followed by a cyclone in end-2016. The situation put a dent into the occupier sentiment, with net absorption for the city declining by 10% y-o-y in 2016 and a further 52% y-o-y in 2017.

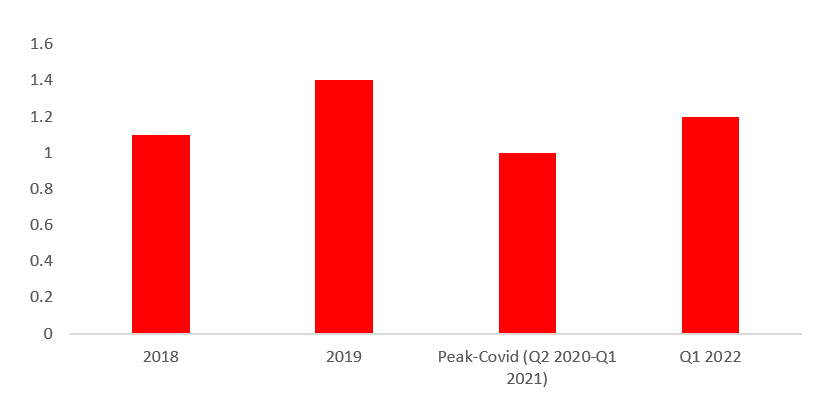

A strong rebound in Chennai’s office market was visible across 2018 and 2019, with office space demand improving by 107% y-o-y. When the city’s skyline was opening up to robust commercial projects and beginning to witness green shoots, the outbreak of Covid-19 in March 2020 halted the growth momentum. The government-imposed lockdown to control the spread of the virus impacted the realty sector by causing business disruption and delaying construction timelines. Office occupiers faced major uncertainties around business dynamics and their real estate portfolios. The impact, though quite intense, was marked by the city adapting to the new normal and quickly pivoting to re-energise itself.

In Q4 2020, the national vaccination drive and dwindling infection rate instilled some confidence in the real estate market, but the second wave of the pandemic in April 2021 again gave a big jolt to the recovery underway. However, the characteristic resilience rose to the fore, with market activity showing a quick uptick once the effect of the second wave started dwindling. The average quarterly net absorption during the peak of the pandemic (Q2 2020 to Q2 2021) reached almost 50% of the average quarterly net absorption witnessed during the pre-Covid 2018 and 2019. Conversely, the net absorption in Q1 2022 surpassed the average quarterly absorption of both pre-Covid and peak-Covid periods.

Table 1: Average Quarterly Net Absorption

| Years | 2018 | 2019 | Peak-Covid (Q2 2020 - Q2 2021) |

Q1 2022 |

|---|---|---|---|---|

| Average quarterly net absorption (in million sq ft) |

0.74 | 0.71 | 0.36 | 1.2 |

Source: JLL Research and REIS

The waning effect of the pandemic and reopening of the city led to overall occupier activity (measured in gross leasing volume terms) in Q1 2022, nearly the average quarterly numbers of pre-Covid (2018-2019) and surpassing the peak-Covid period (Q2 2020-Q2 2021). These are the early signs of strong recovery and growth in Chennai’s office market. The active RFPs in Q1 2022 nearly touched 50% of pre-Covid numbers, which augurs well for overall occupier sentiment and market dynamics.

Figure 1: Average Quarterly Gross Leasing Volume (in million sq ft)

Around 13.4 million sq ft was added to the city’s Grade A stock from 2018 until Q1 2022, and about 11.32 million was absorbed.

Growth- Corridors of Chennai’s Office Market

The submarkets of SBD (Guindy and MPR), SBD OMR (Pre-toll OMR) and PBD OMR (Post Toll OMR) are the key office growth corridors in the city. Together, they are likely to contribute to the city’s 77% of the total operational Grade A stock and almost 85% of the upcoming supply in the next couple of years with a 30-40% pre-commitment rate. These submarkets contribute to almost 60-70% of the total net absorption. These corridors have witnessed rapid growth over the past two decades and have been home to major developers and institutional owners. SBD and PBD OMR are likely to be the leaders in net absorption contribution. Quality supply, pre-commitments and lack of options in the SBD OMR are crucial factors expected to push demand towards these two submarkets going forward.